How to pay in China as a Singaporean – Guide to WeChat Pay, Alipay, Changi Pay, Cash

If you’ve been following Budgetpantry’s Facebook page, you would know that my family travelled to Yunnan, China for the June school holidays. Check out my itinerary posts on Facebook. Might get around to blogging but let’s see.

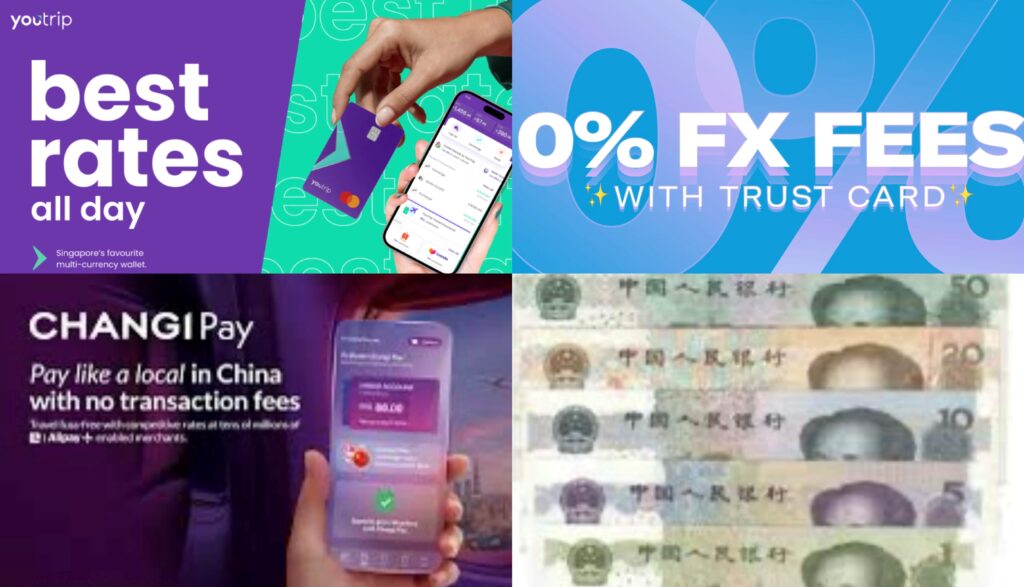

Since posting our Yunnan adventures, many of you have asked me how to pay in China, i.e., how I paid for stuff, and if cash is still accepted. From my experience, yes! But smaller merchants may not have change to return you. In this post, I will share the exchange rates and different payment methods I used in China: 1. Alipay (linked my Trust and YouTrip cards) 2. WeChat Pay (linked my Trust and YouTrip cards) 3. Changi Pay (topped up using PayNow) 4. Cash

- Alipay

Alipay is our favourite platform! The interface is easy to figure out and I linked both my Trust debit card and YouTrip card to the Alipay app. How to pay: either you scan the merchant’s QR code displayed at the cashier (“我扫你”) or get the merchant to scan your QR code (“你扫我”). Cons: Some smaller stalls esp in local markets only accept WeChat Pay, so I suggest you set up both before travelling. - WeChat Pay

WeChat Pay is the most widely accepted payment method in China. It works the same as Alipay but there were a few times where the app timed out and I had to restart it before I could make payment. I linked both my Trust debit card and YouTrip to WeChat. How to pay: same as Alipay, either scan the merchant’s QR code or present yours.

- Changi Pay

Being super kiasu, I also signed up for Changi Pay, a digital wallet that doesn’t require you to download WeChat or Alipay, nor link credit or debit cards. You will be verified with Singpass and you can top up $ into the digital wallet via PayNow. How to pay: Changi Pay is accepted at merchants who accept Alipay in China, so launch the app and scan the merchant’s Alipay QR or present yours. In countries like Hong Kong, it’s only accepted at merchants who accept Alipay+. Cons: the exchange rate is lower than WeChat and Alipay, but could be an ok trade off for folks who don’t wanna download WeChat, Alipay or link cards. Another plus point of Changi Pay is that you CAN transfer to someone else’s Alipay wallet (only if user has a China-based account), which I have personally tried and works. However, there are transaction limits which you can find out on this page: Changi Pay FAQ.

- Cash (Renminbi)

I exchanged about RMB 500 at SG’s money changer before leaving. And I will still recommend having some cash with you. There were 1-2 instances where my data died / reception was wonky and I just couldn’t launch any apps, and the cash came in handy.

Exchange rate:

Exchange rate varies depending on the transaction posting date. For debit/credit cards, I only used Trust and YouTrip to pay China because 0% FX fees! In my same-day example here, the exchange rate of the Trust card was 5.350, YouTrip was 5.357 and Changi Pay 5.284. On other days, Trust card had a better exchange rate and I would say both Trust and YouTrip not much difference overall and are pretty much equal. And to be honest, even Changi Pay’s exchange rate difference is also negligible. Some choose Changi Pay for transactions above 200 rmb as there’s no 3% fees, but you can also ask merchants to split your WeChat/Alipay payments to avoid the fee. Up to individual!

Other tips

There are other ways to pay in China but these were what I used. Note that you cannot use WeChat or Alipay to make payment IN Singapore. So can’t test out before you travel. For YouTrip, you can link either your physical card number or virtual card number to WeChat/Alipay, it doesn’t matter. There’s a wallet feature in WeChat Pay and Alipay. With a non-mainland China issued credit/debit card, you cannot top up funds to your wallet and transfer to friends/tour guides. You can only pay merchants directly.

If you have money in your WeChat Pay or Alipay wallet e.g., from an earlier transaction when your Chinese friends have transferred money to you, then you will be able to transfer wallet-to-wallet. Changi Pay allows wallet transfer to a recipient in China, but with limitations (see above).

To pay a larger amount of money to China drivers/tour guides, I used DBS Remit, which allows same-day overseas funds transfer either to a China bank, or to anyone’s Alipay account (you just need their full name and China phone number linked to their Alipay!) The exchange rate has been super good. $1 SGD was around $5.30 RMB during my travels (May/June 2024).

Now for the perks…

Trust card: Get an in-app scratch card when you sign up with referral code: D1ZTJ2N1. Unveil guaranteed cashback of min. S$5 up to S$1K!

Download the Trust bank app and use my referral code D1ZTJ2N1 when prompted and get an in-app scratch card with guaranteed cashback of S$5 up to S$1K! You can use Trust card to withdraw money at ATMs globally at 0% foreign transaction fees too. Read about my experience withdrawing cash in Taiwan.

Get S$5 with YouTrip

Tap on my YouTrip referral link to sign up, and get S$5 with your first top up. You can also withdraw money at global ATMs!

I hope this guide gives you a better idea of how to pay in China. Check out all my travel posts, such as what we did in Yilan, Taiwan, with kids!